eNovate and Cobi Integrate AI Intelligence to Transform Egypt’s Digital Payment Experience

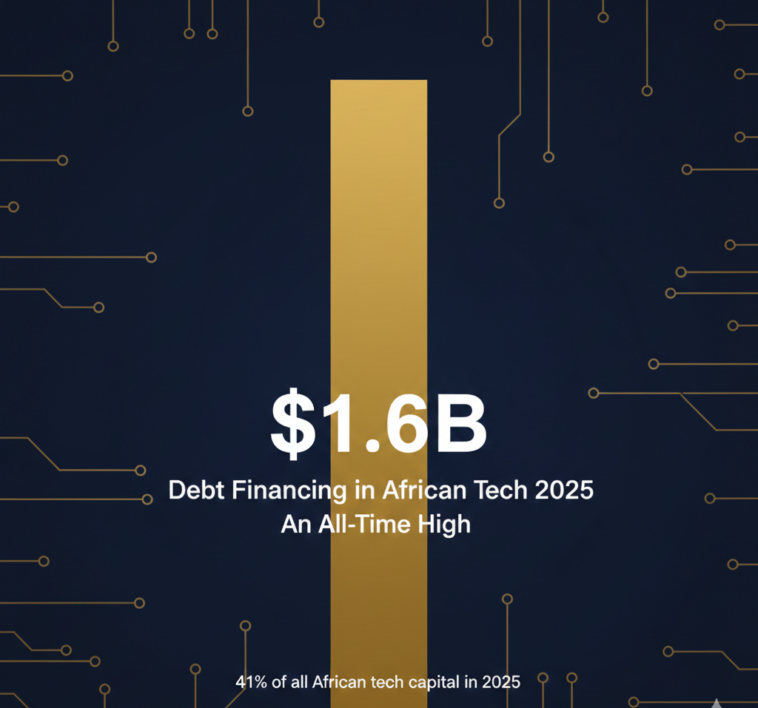

eNovate, a subsidiary of eFinance Investment Group, and Cobi, a UAE-headquartered AI-native customer intelligence platform, announced the integration of Cobi’s AI-powered intelligence infrastructure across its digital payment ecosystem to redefine how young people across Egypt engage with digital financial services. Enabled through Mastercard’s Engage programme, the partnership combines eNovate’s digital payments product suite and Cobi’s AI-powered engagement platform to give financial institutions a new level of intelligence, personalisation, and behavioural insight across their customer base. As the MENA region emerged as a global hub for financial services innovation in 2025, fuelled by government initiatives and rapid digital payments growth, the focus is shifting toward AI-powered engagement and intelligence at scale.

The collaboration begins with the Rize app, eNovate’s flagship digital wallet, where Cobi’s intelligence layer will power real-time personalisation for Egypt’s youth segment. With 85% of people across MENA already using at least one emerging payment method, this allows banks and fintechs to better understand spending behaviours, identify friction, and deliver timely product interventions that drive activation, loyalty, and long-term customer value. The capability will extend across eNovate’s broader digital payment services, forming Egypt’s first large-scale AI-driven portfolio management infrastructure.