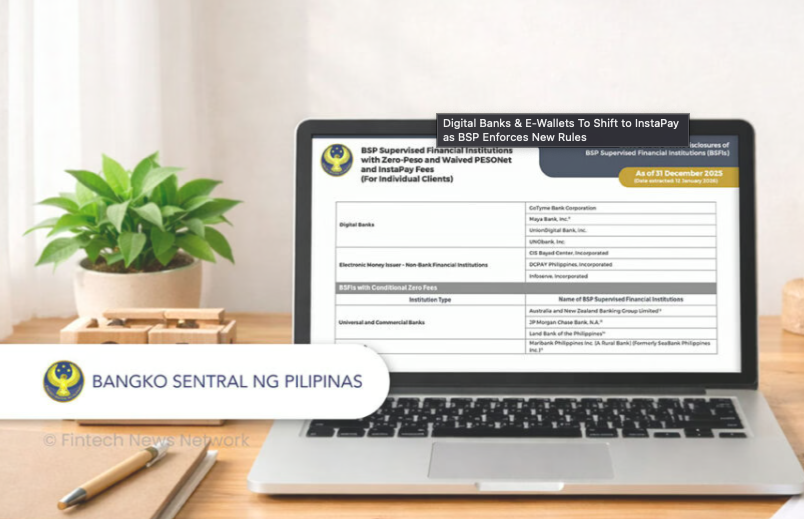

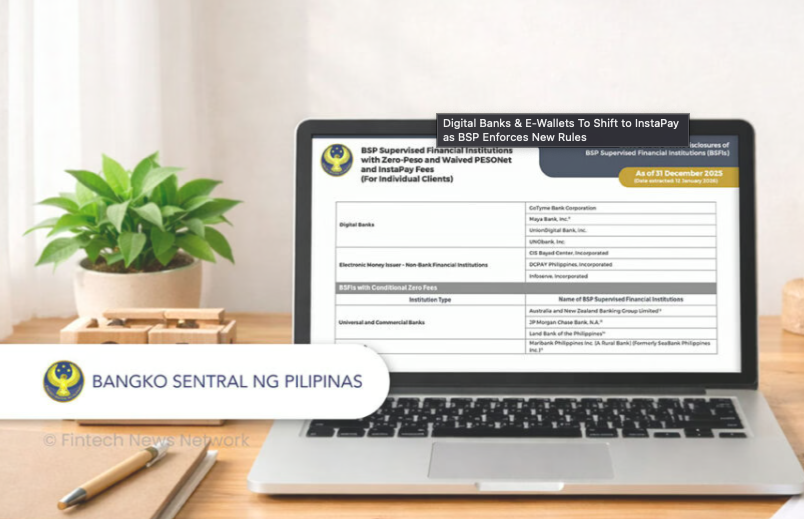

Digital Banks & E-Wallets To Shift to InstaPay as BSP Enforces New Rules

The digital banking landscape in the Philippines is undergoing a significant transition as the Bangko Sentral ng Pilipinas (BSP) and the Philippine Payments Management, Inc. (PPMI) enforce new rules.

These regulations mandate that digital banks and e-wallets utilise standardised payment rails, such as InstaPay and PESONet, rather than proprietary “shortcut” integrations.

A primary result of these changes is the deactivation of linked bank account features.

For instance, GoTyme Bank permanently disabled deposits via linked accounts on 1 February 2026, ending a feature that allowed direct, in-app cash-ins from local banks like BPI.

Similarly, BPI announced that linked accounts in partner e-wallet apps, including GrabPay and Maya, would be deactivated by late January 2026. Customers must now manually send funds using regulated interoperable rails from their bank’s mobile app.