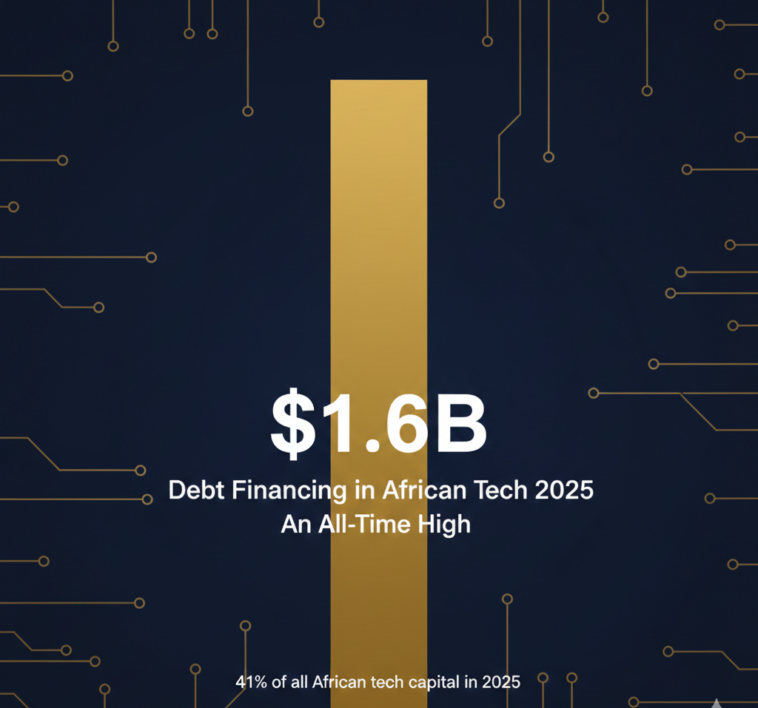

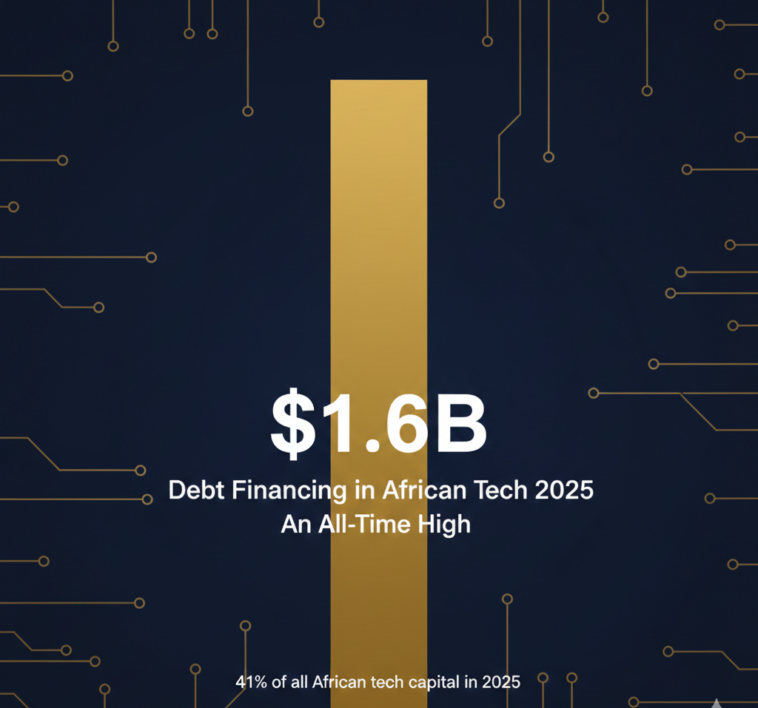

Debt Financing Reaches All-Time High in African Tech: The $1.6B Milestone

Something structural is shifting in how African tech companies raise money, and most of the conversation about African startup funding is missing it.

In 2025, African tech startups raised $1.64 billion through debt financing, a 63% jump from $1.01 billion in 2024 and the highest level ever recorded on the continent. The number of debt transactions also hit a record: 108 deals, up 40% from 77 in 2024. Debt now accounts for 41% of all capital deployed in African tech, up from just 17% in 2019.

This is not a blip. It is a structural transformation quietly reshaping the African startup ecosystem and what it means for a company to reach scale.

What Debt Financing Actually Means for Startups

Unlike equity financing, where investors take an ownership stake in exchange for capital, debt must be repaid, typically with interest. For a long time, this made it inaccessible to most African startups, which lacked the predictable revenues and cash flow visibility that lenders require.